Charitable Gift Annuity Rates to drop July 1…Last chance to lock in on higher returns while helping Landmarks

Landmarks is sending this notice because we recently received word that those rates will decrease July 1, which means that the payment to you on any annuity after that date will be lower than on an annuity taken out now.

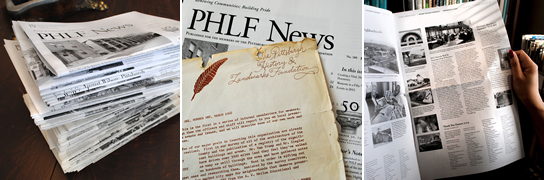

Charitable gift annuities are a wonderful way to enhance your retirement income and help Landmarks preserve the places that make Pittsburgh home! A charitable gift annuity is an arrangement where, in exchange for an irrevocable gift of money or property, the Pittsburgh History & Landmarks Foundation will pay you (or you and a spouse) fixed payments for life-no matter what happens to the economy. On the death of the last income beneficiary, the remainder is paid to Landmarks to support our preservation mission. The amount of annual annuity income you receive is determined by the number of income beneficiares (just you or you and a spouse) the age or age of the income beneficiaries, the size of the gift and interest rates set by the American Council on Gift Annuities.

For most charitable gift annuities, a substantial portion of the payment is free of tax during the period of your life expectancy and you would be entitled to a charitable deduction, subject to certain conditions, in the year of the gift.

How can I get more information about a charitable gift annuity?

To learn more about your specific situation, contact Jack Miller at jack@phlf.org or 412-471-5808, ext. 538 or use the gift calculator on our web site at http://plannedgifts.phlf.org/design.php to see how you and Landmarks can benefit from you charitable gift annuity. Remember, time is of the essence to lock in the pre-July 1 rates.

NOTE: Any U.S. federal tax references contained herein are not intended or written to be used, and cannot be used, for the purpose of (i) avoiding penalties under the Internal Revenue Code or (ii) promoting, marketing or recommending to another party any transaction or matter addressed herein. Landmarks does not provide legal or tax advice. You should always consult your personal legal or tax advisors when considering any planned gift. A copy of the official registration of Pittsburgh History & Landmarks Foundation may be obtained from the PA Department of State by calling toll free, within Pennsylvania 1-800-732-0999. Registration does not imply endorsement.