Category Archive: Planned Giving

-

New Tax Law Extends Charitable IRA Rollover for 2010 and 2011

On Dec. 17, President Barack Obama signed the Tax Relief, Unemployment Insurance Reauthorization and Job Creation Act of 2010. Included in the package is an extension of charitable IRA rollovers. Here are some important provisions to note:

- Individuals age 70 ½ and older may once again request direct transfers of funds from Individual Retirement Accounts (IRAs) to Landmarks without income tax on gifted funds.

- The funds must be directly transferred from IRA accounts to Landmarks (donors should ask their IRA custodians for special forms to make these requests).

- Each individual is entitled to make a total of $100,000 in gifts to charities each year under this provision.

- If you have not yet taken your IRA Required Minimum Distributions (RMDs) for 2010, you may partially or wholly satisfy that requirement through an IRA rollover gift made by January 31, 2011.

- These contributions do not qualify donors for an additional charitable income tax deduction as not being taxed on the withdrawal is worth even more than a standard charitable deduction.

- Only standard IRAs and Roth IRA accounts qualify under this law; other retirement accounts such as 401(k), 403(b), SEP, KEOGH, and SIMPLE IRA plans cannot be used to make an IRA rollover gift.

- Donors of IRA rollover gifts must receive no personal benefits from this gift nor are they available for planned gifts such as charitable remainder trusts or gift annuities.

The provision is a significant opportunity for donors who:

- Hold assets in their IRAs that they do not need;

- Would like to make a large one-time gift;

- Are subject to the two-percent rule that reduces itemized deductions;

- Do not itemize; or

- Plan to leave part or all of their IRA to Landmarks at death.

For more information on how the Charitable IRA Rollover may be beneficial to you and Landmarks, please contact our Director of Gift Planning, Jack Miller, at 412-471-5808, ext. 538 or jack@phlf.org.

-

Historic Downtown Site Sold

By Thomas Olson, PITTSBURGH TRIBUNE-REVIEW

Thursday, September 30, 2010

The Pittsburgh History & Landmarks Foundation was given the easement to the historic Burke Building, Downtown, by the Western Pennsylvania Conservancy so the foundation can assure no future owners tear it down or alter its exterior. Jasmine Goldband | Tribune-Review

The Western Pennsylvania Conservancy has sold the oldest architect-designed building in Pittsburgh — and granted an easement to the Pittsburgh History & Landmarks Foundation to make sure it’s never torn down.

Built in 1836, the Burke Building at 209 Fourth Avenue, Downtown, was sold Monday to Burke Building Enterprises L.P., said conservancy spokeswoman Stephanie Kraynick.

She declined to provide further information about the purchaser but described the partnership as people “who appreciate the historical quality of the building and plan to preserve” it.

The three-story, stone structure — a striking contrast to the modern PPG Place that sits next to it — is one of the few remaining structures to survive the city’s great fire of 1845. The building is unoccupied.

“It is a really important building,” said Arthur Ziegler, president of History & Landmarks. “Anyone who owns the building now and forevermore is subject to the condition that they can’t demolish it or change the exterior without our consent.”

“The conservancy has easements on lots and lots of land. They gave us this (easement) because we protect buildings,” he said.

The conservancy’s headquarters was located in the Burke Building until September 2007, when the organization relocated to Washington’s Landing.

The architect was John Chislett, an British native who relocated to New York in 1832. He moved to Pittsburgh a year later and remained here.

“The Burke Building is extremely handsome and the oldest building we’ve got,” said Al Tanner, the foundation’s historical collections director. “Over the years, it housed a bank, a restaurant, and a variety of other (tenants).”

Three other buildings in Pittsburgh that Chislett designed are still standing. The Gateway and Lodge of Allegheny Cemetery, which are two adjoining structures in Lawrenceville; and the Widows and Orphans Society of Allegheny City building on the North Side.

Tanner said that in Chislett’s day, he was probably best known in Pittsburgh for designing the original Allegheny County Court House in 1841. It burned down in 1882 and was replaced two years later with a design by the world-famous H.H. Richardson, who designed other buildings in this region.

-

Landmarks 2009 Outstanding Philanthropic Organization

Jack Miller

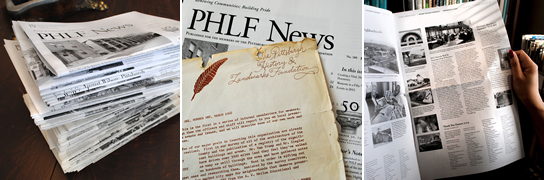

PHLF News

November 12, 2009KDKA Radio and Television personality Larry Richert and more than 300 guests were on hand at the Sheraton at Station Square on November 11 to honor the Pittsburgh History & Landmarks Foundation as the region’s 2009 Outstanding Philanthropic Organization.

Landmarks President Arthur P. Ziegler, Jr. accepted the award, presented by the Western PA Chapter of the Association of Fundraising Professionals as part of the National Philanthropy Day Celebration. In accepting the award, Arthur credited the dedication of Landmarks’ board, staff, volunteers, members and generous donors as the reason for our success.

Despite the fact that Landmarks is not a grant-making foundation, AFP singled out Landmarks for: “its unique record of civic responsibility, spinoff impact on other regional non-profit programs, proactive role in motivating others to take leadership roles toward philanthropy and community involvement, and distinguishing itself by encouraging creative and innovative programs in the advancement of philanthropy in general.”

-

Cruise to Honor PHLF Donors

by Jack Miller

PHLF News

August 13, 2009Landmarks’ 2009 Heritage Society reception and cruise will take place on the Gateway Clipper Fleet’s Princess on Tuesday, September 15 from 6:15 – 8:15 p.m.

The event will honor 2008/09 donors of at least $1,000 and individuals who have included Landmarks in their estate plan or as a beneficiary of a planned gift.

If you meet one of these criteria and have not yet received your invitation, please contact Jack Miller at jack@phlf.org or 412-471-5808, ext. 538 as soon as possible.

The 2009 Heritage Society Donor Recognition Event is underwritten by The North Shore Group at Morgan Stanley Smith Barney in Great Neck NY, Alan Greenberg, Senior V.P., Financial Advisor, and Matthew A. Thompson, CIMA® Associate V. P., Financial Advisor, for which Landmarks extends its appreciation.

-

Greene County Conservation Easement to Protect Farm

By Jack Miller

By Jack Miller

PHLF News

August 4, 2009Charles Evans Hunnell has donated a preservation and conservation easement to Landmarks that will protect his 136-acre farm located just west of Waynesburg, PA.

The easement will not only help to preserve the farm-related buildings on the century-old farm but also protect its land from commercial development.

Mr. Hunnell also made a gift to endow the monitoring of the easement in perpetuity.

This is the second Greene County farm protected by Landmarks and brings to 10 the number of properties on which Landmarks has obtained a historic preservation and conservation easement in the past four months.

-

Act Now to Take Advantage of and to Preserve the Enhanced Federal Tax Incentive for Easements

Any individual who donates a preservation easement to a qualified charity, such as Landmarks, is allowed to deduct the value of the easement as a charitable contribution, provided the donation meets certain requirements specified in the Tax Code. Congress recently increased the incentives for donating conservation easements by raising the deduction limit for charitable donations of conservation easements to 50% of an individual’s adjusted gross income, 100% in the case of certain donations with respect to farmland, and extending the carry-forward period for donations that exceed that limit to 15 years. These enhanced deduction limits are set to expire on December 31, 2009. After that date, unless Congress acts, donations of conservation easements will be deductible only to the extent of 30% of adjusted gross income and the carry-forward period for excess donations will be reduced to 5 years.Landmarks accepts donations of preservation easements on historic buildings and farms. To date, Landmarks has received more than twenty preservation easements, protecting a wide range of historic properties including major downtown commercial buildings, unique residential structures, and approximately 1,600 acres of farmland.If you are interested in donating a preservation easement on your historic home, you need to act by December 31, 2009 in order to take advantage of the increased deduction limit.If you think Congress should encourage historic preservation by making the increased deduction limit permanent, you are not alone. Bipartisan legislation has been introduced in Congress to make the enhanced incentives permanent through the Conservation Easement Incentive Act, H.R. 1831, and the Rural Heritage Conservation Act, S. 812. To learn more about the enhanced tax incentives for conservation easements and how you can help make them permanent, please visit The Land Trust Alliance’s website at www.lta.org.Any individual who donates a preservation easement to a qualified charity, such as Landmarks, is allowed to deduct the value of the easement as a charitable contribution, provided the donation meets certain requirements specified in the Tax Code.

Congress recently increased the incentives for donating conservation easements by raising the deduction limit for charitable donations of conservation easements to 50% of an individual’s adjusted gross income, 100% in the case of certain donations with respect to farmland, and extending the carry-forward period for donations that exceed that limit to 15 years.

These enhanced deduction limits are set to expire on December 31, 2009. After that date, unless Congress acts, donations of conservation easements will be deductible only to the extent of 30% of adjusted gross income and the carry-forward period for excess donations will be reduced to 5 years.

Landmarks accepts donations of preservation easements on historic buildings and farms. To date, Landmarks has received more than twenty preservation easements, protecting a wide range of historic properties including major downtown commercial buildings, unique residential structures, and approximately 1,600 acres of farmland.

If you are interested in donating a preservation easement on your historic home, you need to act by December 31, 2009 in order to take advantage of the increased deduction limit.

If you think Congress should encourage historic preservation by making the increased deduction limit permanent, you are not alone. Bipartisan legislation has been introduced in Congress to make the enhanced incentives permanent through the Conservation Easement Incentive Act, H.R. 1831, and the Rural Heritage Conservation Act, S. 812.

To learn more about the enhanced tax incentives for conservation easements and how you can help make them permanent, please visit The Land Trust Alliance’s website at www.lta.org.

-

Landmarks Honored By Association of Fundrasing Professionals

The Western PA Chapter of the Association of Fundraising Professionals has named Landmarks its 2009 Outstanding Philanthropic Organization for its exemplary record of civic responsibility in support of philanthropic causes; its demonstrated generosity to substantially impact regional non-profit programs; for encouraging and motivating others to take leadership roles toward philanthropy and community involvement; by distinguishing itself by encouraging creative and innovative programs; and by its advancement of philanthropy in general.The award will be presented as part of the National Philanthropy Day Celebration on Wednesday, November 11, from 6:00 – 9:00 p.m. Ironically, the awards ceremony and reception will be held at the Sheraton Hotel in Station Square, a facility that would not exist today without Landmarks’ foresight.If you would like to purchase tickets to the event, please contact Jack Miller at jack@phlf.org for additional information.by Jack Miller

PHLF News

July 30, 2009The Western PA Chapter of the Association of Fundraising Professionals has named Landmarks its 2009 Outstanding Philanthropic Organization for:

- its exemplary record of civic responsibility in support of philanthropic causes;

- its demonstrated generosity to substantially impact regional non-profit programs;

- for encouraging and motivating others to take leadership roles toward philanthropy and community involvement;

- by distinguishing itself by encouraging creative and innovative programs; and by its advancement of philanthropy in general.

The award will be presented as part of the National Philanthropy Day Celebration on Wednesday, November 11, from 6:00 – 9:00 p.m. Ironically, the awards ceremony and reception will be held at the Sheraton Hotel in Station Square, a facility that would not exist today without Landmarks’ foresight.

If you would like to purchase tickets to the event, please contact Jack Miller at jack@phlf.org for additional information.

-

Donor Magazine Format to Change in Cost-Cutting Move

by Jack Miller

PHLF News

May 15, 2009Landmarks has announced that it will discontinue publishing the hard copy version of its estate planning magazine, Landmark Legacies. Instead, the magazine will be posted in a pdf format at http://plannedgifts.phlf.org/newsletters.php. The move is expected to free up $2,000 annually that can be applied to mission-related programs & projects.

The move follows a salary freeze and voluntary pay cuts for higher compensated employees to help lower operating costs during the recession.