Category Archive: News Wire Services

-

Firm unveils plans for $40 million E. Liberty restoration, development

Thursday, June 07, 2007

Thursday, June 07, 2007

By Diana Nelson Jones,

Pittsburgh Post-GazetteA Washington, D.C., firm presented plans yesterday for The Montrose Exchange, a $40 million hotel, office and retail development in the heart of East Liberty, at a meeting with the Urban Redevelopment Authority.

Six buildings would be restored and one built on the site of nine existing buildings, said architect Andrew Moss. Montrose Exchange refers to the name of East Liberty’s former telephone exchange.

The Morgan Development Group began securing land four years ago. It has a franchise agreement with the Hotel Indigo, a member of the Intercontinental Group, for a 135-room boutique hotel. It would consist of four buildings in the block bounded by Highland Avenue and Broad, Kirkwood and Whitfield streets, said Nigel Parkinson, the firm’s principal.

The now-dilapidated six-story Kirkwood Hotel would be restored as the historic reference and the tallest building of the multistory hotel, said Mr. Moss. The hotel components would be connected and a new public plaza created in the block.

A large, modern office building beside the Kirkwood Hotel would be completely redesigned and reconfigured. Two buildings across Highland and one across Broad from the hotel would become two stories of retail and office space.

The plan includes restoration of the former American Legion building, the proposed location of a sister restaurant of Latin Concepts in Washington, D.C., said Mr. Parkinson.

He said Pittsburgh’s character and “great institutions” beckoned him to invest here.

“Last year, I was at a class reunion, and one of my professors was from Carnegie Mellon,” he said. “When I told him about my project, his wife’s eyebrows shot up and she said, ‘I’m from Shadyside!’ ”

Jerome Dettore, executive director of the Urban Redevelopment Authority, said the plan “is very, very solid, very impressive.”

“These guys have put their money where their mouth is. They have assembled the property, they have agreements in place and are ready to move,” he said.

From the URA, the developer is requesting gap-financing assistance, grants for facade restoration and help with public rights of way, infrastructure and parking areas.

“When there’s simply financing in the way, that’s the best role we can play,” said Mr. Dettore, whose staff often has to assemble sites for developers. “The chances of this [project] happening are extremely good.”

Mr. Moss said local businesses would have opportunities to locate in the retail spaces, which include seven in one building, three in another and an undetermined number in an additional 6,900 square feet.

Besides offices, a ballroom, meeting space or a nightclub are possibilities for a portion of the second floors, said Mr. Moss.

Part of the plan is to redesign an open space on Broad Street as a public green space “with a kiosk, a cafe with outdoor tables and an area for small events,” he said.

A Marriott Spring Hill Suites being planned two blocks up Highland made the agreement easier for the Hotel Indigo, said Mr. Moss. “They didn’t want to be the only one. There’s a lack of hotels” in the East End neighborhoods compared with demand, mainly because of nearby medical facilities.

Mr. Moss said the plan was to restore the hotel for certification by the U.S. Green Building Council.

(Diana Nelson Jones can be reached at djones@post-gazette.com or 412-263-1626. )

-

Homewood pride comes before bricks and mortar

Wednesday, June 06, 2007

Wednesday, June 06, 2007

By Elwin Green,

Pittsburgh Post-GazetteThe redevelopment of Homewood will be more a matter of community pride than of bricks and mortar, the keynote speaker at a workshop on commercial development said yesterday.

“We’ve got to lift the community up and highlight the positive things,” said Clarence F. Curry Jr., Minority/Woman Owned Business Enterprises coordinator for the Sports and Exhibition Authority. “We’ve got to toot our own horn.”

Mr. Curry said the community’s redevelopment should build on “magnets,” such as the library, the Alma Illery Health Center and the neighborhood campus of the Community College of Allegheny County, which already attract visitors to the neighborhood.

“They come here to the library, they leave with their money in their pocket.” he said. “We need something to encourage them to stop and spend their money.”

Mr. Curry was one of four speakers at the workshop sponsored by the Homewood Brushton Community Coalition Organization, held at the Homewood branch of Carnegie Library. HBCCO has a community plan for development and is looking for an executive director, but has no land bought and no finances finalized.

Robert Rubinstein, director of economic development at the Urban Redevelopment Authority, offered a glimpse into the information-gathering process that major retailers use when deciding where to locate. Based on data about the area within a half-mile radius of one of the neighborhood’s busiest intersections, at Frankstown and Homewood avenues, he said residents could be expected to spend $9 million on groceries in 2008. Since the average grocery store needs $20 million in annual sales to be feasible, that makes the neighborhood an unlikely target for such a store.

However, he said, Homewood could be a good place to develop “convenience retail” stores such as the Family Dollar slated to open this summer on Frankstown Avenue. It also could offer opportunities for developing light industrial space for manufacturing such goods as T-shirts or compact discs, or for use as artist studios or galleries.

Countering the perception that the URA funds only large-scale developments, Mr. Rubinstein said 90 percent of what the organization finances is “small neighborhood projects.”

J. Arthur Gilmer, project manager for FaithWorks, a Homewood-based nonprofit organization that offers training and consulting to other nonprofits, said the glimpse of a developer’s perspective on the neighborhood was valuable. “We see it one way, walking around the community, and other people see it differently.”

(Elwin Green can be reached at egreen@post-gazette.com or 412-263-1969.)

-

City approves tax break for new housing in 29 areas

Wednesday, June 06, 2007

Wednesday, June 06, 2007

By Mark Belko,

Pittsburgh Post-GazetteCity Council approved tax breaks yesterday designed to spur new housing Downtown even as it expressed misgivings about excluding some neighborhoods from the program.

The measure, approved 8-0, will waive the first $2,700 in city property taxes for 10 years on new housing units built Downtown and in 28 other city neighborhoods.

“It’s symbolic of our effort to prioritize and give incentives for people to move back Downtown and to create incentives for people to move back into neighborhoods that haven’t seen investment for some time,” Mayor Luke Ravenstahl said.

Approval came even though several council members complained about neighborhoods being excluded from the program, which based eligibility in part on a “vitality index” that factored in population losses, education levels, single-parent families, poverty, low home ownership, high vacancy, tax delinquency, violent crime and other factors.

In fact, several Fairywood residents made a last-ditch appeal to council to be added among the eligible neighborhoods, but their pleas fell on deaf ears.

“We never get anything in our neighborhood. We’re always left out, except for things that don’t work,” Donna Washington, a member of the Fairywood Citizens Council, said afterwards.

Councilman William Peduto, who had proposed a competing tax break that would have applied to Downtown and adjacent neighborhoods, said the residents had a point.

“When you choose 29 neighborhoods to be the winner, you’re also choosing 60 neighborhoods to be the loser,” he said.

Several other council members, including Daniel Deasy, who represents Fairywood, also expressed disappointment about neighborhoods being left out but at the same time expressed hope that the program could be expanded in the future.

The Ravenstahl administration has said that going citywide would have cost the city $75 million over the life of the program. As structured, the abatement is designed to replace the new property tax revenue the city is giving up with gains in wage and other taxes.

Mr. Peduto said one possible avenue to explore in years ahead would be income-based property tax breaks as well as incentives built around green buildings, historic preservation and public art.

While the program isn’t perfect, it does lend assistance to efforts to bring more housing Downtown, he said.

Lucas Piatt, vice president of real estate for Millcraft Industries, the Washington County developer bringing condominiums to the former Lazarus-Macy’s building and apartments to the old G.C. Murphy’s store Downtown, described the abatements as a “good start.”

“I think it’s definitely going to help us,” he said.

He said he was also hoping that Allegheny County and the city school district would adopt similar measures. He said abatements in Philadelphia have helped to revitalize that city.

Allegheny County Chief Executive Dan Onorato expects to have an announcement soon relating to a possible county tax abatement program, spokesman Kevin Evanto said. For the initiative to be successful, Mr. Onorato believes the city, county and school district all must participate, he said.

While Fairywood residents complained about being left out, representatives from several other neighborhood groups spoke in favor of the program before the vote.

Cindy Cassell, who heads up economic development and project management for Neighbors in the Strip, said the program could help to stimulate the redevelopment of about 100 vacant properties in the Strip District.

“It makes urban living in Pittsburgh more affordable for more people,” she said.

The city is still writing regulations for the program, a process that could take at least a month. Abatement applications will be accepted for five years.

(Rich Lord contributed to this story. Mark Belko can be reached at mbelko@post-gazette.com or 412-263-1262. )

-

Iron City’s new owners predict full-bodied future

By Joe Napsha

By Joe Napsha

TRIBUNE-REVIEW

Wednesday, June 6, 2007The new owners of Pittsburgh Brewing Co. believe the brewery is well-positioned for growth under a bankruptcy reorganization plan approved Tuesday, and a beer industry expert agrees.

The ownership group, led by Connecticut investment manager John N. Milne, plans to take over the Lawrenceville brewery on July 7 and operate it under the name Iron City Brewing Co., which was the name of the brewery when it was formed in 1861.“Today marks a positive first step for Iron City Brewing Co.,” said Timothy Hickman, who will become the brewery’s president, in a statement yesterday.

U.S. Bankruptcy Judge M. Bruce McCullough approved the reorganization plan, which will enable the beermaker to emerge from bankruptcy for the first time since Dec. 7, 2005.

“Pittsburgh Brewing was in bankruptcy for two main reasons — a weak balance sheet and an excessive cost structure. The reorganization plan addresses those issues and positions it well for future growth,” Hickman said.

A beer industry expert believes that with the right business plan, the new ownership can succeed.“They are just sitting on a gold mine,” because Pittsburgh Brewing’s brand equities “are just phenomenal,” said Daniel Bradford, publisher of All About Beer magazine in Durham, N.C.

Even so, though the new owners pledge to spend $4.1 million on a new kegging line and a new gas-fired boiler, and $500,000 on marketing the brands, having money to spend is not a guarantee of success, Bradford said.

“It is not just a question of (spending) money. You have to be strategic, and you have to execute well,” Bradford said.

Bradford believes the news ownership can “tap into some really strong trends right now.” One of those is what he calls the “retro trend,” the popularity of older beer brands like Iron City and IC Light, among adults in their 20s.

The new ownership group has an opportunity to create a specialty beer segment, a whole new brand they can roll out within the existing market, and add value to the business, Bradford said. Brewers such as High Falls Brewing Co. of Rochester, N.Y., which brews the Genesee family of beers, along with the Matt Brewing Co. of Utica, N.Y., and City Brewing Co. of La Crosse, Wisc., which bought the former Latrobe Brewing Co. plant, are among such success stories.

“It’s not just an extension of Iron City. It is thinking more along lines that reflect the indigenous culture of Western Pennsylvania,” Bradford said.

The new ownership group will take over the brewery from Joseph R. Piccirilli, who bought the business out bankruptcy in 1995. Milne’s group convinced creditors to accept a repayment plan that offers creditors no more than $5.03 million on claims totalling more than $26 million. There was a near-unanimous approval of the reorganization plan, brewery attorney Robert O. Lampl told the judge.

“I did not think we would be here today,” McCullough said as he approved the reorganization plan during a 15-minute hearing. However, he added a cautionary note, saying, “I don’t know how long it will last.”

The developments yesterday “give us optimism,” said George Sharkey, president of the negotiating board for the bottlers and brewers, members of the International Union of Electrical Workers-Communication Workers of America Locals 144b and 22b. “We’re hoping for great things. We hope the people of Pittsburgh buy the beer and support the business.”

Milne’s group projects that it can boost sales from $30.5 million in its first full year of operation to $37.4 million after three years.

The group will be able to take advantage of a 15 percent reduction in union workers’ wages and benefits under a contract that takes effect when new ownership is in place. Retirement costs were cut by terminating the union-sponsored pension plan, and medical insurance costs for employees were reduced by 20 percent.

Joe Napsha can be reached at jnapsha@tribweb.com or (412)-320-7993.

-

City Council approves tax abatements

By Jeremy Boren

By Jeremy Boren

TRIBUNE-REVIEW

Tuesday, June 5, 2007Tax breaks designed to attract home builders to Downtown and 28 neighborhoods won City Council’s OK today but excluded some low-income neighborhoods, residents complained.

“It seems to me that the city is trying to upscale the city, and there’s no room for lower income people,” said Donna Washington, 51, a Fairywood resident who told council that her neighborhood should be eligible for the tax breaks.

“We are always left out,” said Washington, a member of the Fairywood Citizens Council. “There are a lot of people who would like to do work on their homes … and they can’t afford (the higher taxes).”

Beginning July 1, those who build new housing — or significantly improve existing residential property in the designated neighborhoods — would be exempt from the city’s 10.8-mill property tax for 10 years.

The tax break applies to the increase in value of new developments capped at $250,000. For example, the owner of a new apartment building worth $250,000 would not have to pay $2,700 a year in property taxes, creating $27,000 in savings over the decade.

The City Planning Department created a “vitality index” to determine which neighborhoods would be eligible for the program. The department assigned scores to neighborhoods based on data such as housing vacancy, violent crime, income, education levels and population decreases.

The bill, proposed by Mayor Luke Ravenstahl, passed 8-0 today. Councilman Len Bodack was absent.

Nancy Noszka, director of real estate with the Northside Leadership Conference, likes the tax break program and said if it entices home builders to come to the city “the program will help stabilize our communities.”

Cindy Cassell, project manager for the Neighbors in the Strip community group, said the tax breaks could persuade developers to improve some of the estimated 100 vacant properties in the Strip District.

“The 10-year tax abatement will make the cost of rehabbing these old buildings more affordable,” she said.

Councilman Bill Peduto said the mayor’s office should have focused the tax breaks on Downtown because it has the greatest potential for new development that would eventually feed the tax base after the 10-year abatement.

He said the bill has “flaws” because the Planning Department’s vitality index should have been based solely on income, akin to federal Community Development Block Grant programs.

“This is not perfect legislation; it definitely has its flaws. But we definitely have an opportunity to move forward and see some development Downtown,” said Peduto. He said he voted for the legislation because he believes Pittsburgh lags behind other major U.S. cities in offering such tax breaks.

In addition to Downtown, eligible neighborhoods for the tax break are: Allentown, Arlington, Beltzhoover, California-Kirkbride, East Allegheny, Elliott, Esplen, Fineview, Hays, Hazelwood, Homewood North, Homewood South, Homewood West, Knoxville, Larimer, Lincoln-Lemington/Belmar, Lower Lawrenceville, Manchester, Marshall-Shadeland, Mt. Oliver, Perry South/Perry Hilltop, Sheraden, Spring Garden, the Strip District, the Upper Hill District, Upper Lawrenceville, Uptown and the West End.

Jeremy Boren can be reached at jboren@tribweb.com or (412) 765-2312.

-

New owners of Pittsburgh Brewing to take over July 7

By Joe Napsha

By Joe Napsha

TRIBUNE-REVIEW

Tuesday, June 5, 2007Pittsburgh Brewing Co.’s 18-month journey through bankruptcy court ended today when a federal judge approved a reorganization plan that gives the brewery new owners and new source of money to modernize.

U.S. Bankruptcy Judge M. Bruce McCullough today gave his stamp of approval to a plan that was approved last month in a nearly unanimous vote. All groups of creditors — those whose debt was secured by liens and those who debts were unsecured — approved the reorganization plan, said Robert O. Lampl, Pittsburgh Brewing’s attorney.

Commenting on the successful reorganization of the bankrupt brewery, McCullough said that when he took the case in December 2005, “I did not think we would be here today.” He added a cautionary note, saying, “I don’t know how long it will last.”

The new ownership group, led by Connecticut equity fund manager John N. Milne, will take over on July 7, not Thursday, as it had been proposed in the reorganization plan. The new owners need additional time to get permits from the Allegheny County Health Department and wrap up other details related to the bankruptcy, said Joel Walker, attorney for Pittsburgh Brewing Acquisition LLC., the company that will fund the brewery.

Milne’s group convinced creditors to accept a repayment plan that will offer creditors no more than $5.03 million, on claims that totalled more than $26 million. If the plan failed and the brewery were liquidated, the creditors might not receive any repayment, Pittsburgh Brewing said.

The 147-year-old Lawrenceville brewery, maker of Iron City, IC Light and Augustiner brands, will be operated under the name of Iron City Brewing Co., Walker said.The ownership group has promised to invest about $4.1million to modernize the brewery, including a new kegging line and boiler. In addition, increased marketing efforts will be launched to promote the brewery’s brands, which include Iron City, IC Light, Golden Lager and Augustiner, said Timothy Hickman, who will become the brewery’s president next month.

“It gives us optimism and we’re hoping for great things,” said George Sharkey, a negotiator for the local unions representing the brewery’s 150 bottlers and brewers.

Pittsburgh Brewing President Joseph Piccirilli, who bought the brewery in bankruptcy court in 1995 for $29.4 million, did not attend today’s hearing and declined a request for a comment. Piccirilli will serve as a consultant for three months after the sale, but will not play a long-term role in the management of the brewery, according to the court-approved plan.

The brewery filed for bankruptcy on Dec. 7, 2005, after the Pittsburgh Water & Sewer Authority threatened to shutoff its water over an estimated $2.5 million in unpaid water and sewage bills. Operating under Chapter 11 of the bankruptcy code, the brewery was able to withhold paying debts prior to its bankruptcy filing, while it continuing to operate.

But, even after being relieved of those old debts, the brewery has struggled. Production was slowed last month because the brewery did not have sufficient funds to pay for the raw materials to make beer. Brewery attorney Robert O. Lampl said suppliers wanted to be paid in cash for their products.

The brewery’s reorganization plan is based on receiving public funding from a combination of state, Allegheny County, City of Pittsburgh . The new owners say they want $250,000 grant and low-interest loans of $500,000 in low-interest loans from government sources within the first two years of its operation.

Milne’s group says that new efforts in marketing can boost sales of the brewery’s Iron City, IC Light and Augustiner brands to $30.5 million in its first full year of operation. The brewery’s revenues were $27 million through the first 10 months of 2005.

A beer industry expert believes a new management can succeed in reviving Pittsburgh Brewing.

“The brand equities on those beers (Iron City and IC Light) are just phenomenal. They can tap into some really strong trends right now ,” said Daniel Bradford, publisher of All About Beer magazine in Durham, N.C.

One of those trends is what Bradford calls the “retro trend” — the popularity of older beer brands among young adults in their 20s. “Retro is cool.”

Pittsburgh Brewing’s new owners also can tap into the “support your local brewery” movement among beer drinkers, Bradford said.

The new ownership group also has an opportunity to create a specialty beer segment, a whole new brand they can roll out within their existing market, and add value to the business, Bradford said. Brewers such as High Falls Brewing Co. of Rochester, N.Y., which brews the Genesee family of beers, along with the Matt Brewing Co. of Utica, N.Y., and City Brewing Co. of La Crosse, Wisc., which bought the former Latrobe Brewing Co. plant, are among such success stories.

“It’s not just an extension of Iron City. It is thinking more along lines that reflect the indigenous culture of Western Pennsylvania,” Bradford said.

“It is not just a question of (spending) money. You have to be strategic and you have to execute it well,” Bradford said.

“They need to be very judicious. They are just sitting on a gold mine,” Bradford said.

Joe Napsha can be reached at jnapsha@tribweb.com or (412)-320-7993.

-

Meeting airs arena concerns

By Kevin Crowe

By Kevin Crowe

TRIBUNE-REVIEW

Tuesday, June 5, 2007The displacement of families and businesses caused by the construction of the Civic Arena in the late-1950s was on the minds of some residents who attended a meeting Monday about the design and construction of the Penguins’ new arena.

Lois Cain, 69, grew up in the Hill District and lived there during the construction of what now is the Mellon Arena. She watched some of her neighbors and friends get forced out of the Hill. There were public input meetings at that time, she said, but the recommendations made by the community quickly were forgotten.“I lived through this equation,” Cain told about 300 people who attended the meeting at the arena. “The Penguins have never been a friend of the Hill District.”

Cain’s comments underscored the feeling of distrust in many of the comments and questions fielded by the meeting’s hosts, representatives from the Penguins, the city Planning Department, the Sports & Exhibition Authority and Urban Design Associates, the development firm hired by the Penguins to help run the meetings, and members of organizations based in the Hill District.

The meeting was held to organize focus groups with the goal of getting input from the public about the construction and design of a $290 million arena Uptown, said host Don Carter, of Urban Design Associates.

It was the first step in a public participation process the arena project must follow to gain approval from the City Planning Commission.In response to the comments questioning the process by which public input would be handled, City Councilwoman Tonya Payne said she wanted city planners to forward minutes from the focus group meetings to her office.

“If that information can get presented to my office, I’ll make sure it gets to the community,” she said, drawing applause.

Carter said that while he was happy so many people attended last night’s meeting, the time to discuss specifics of the new arena will be during the focus group meetings. They will be held as soon as a traffic study of the area surrounding the proposed arena is completed, and the times, dates and locations will be available on the city’s Web site, he said.

Carl Redwood, a spokesman for the One Hill Community Benefit Agreement, said the meetings should be about “more than just bricks and mortar.”

Redwood led about 50 people from Freedom Corner at Crawford Street and Centre Avenue to the arena for the meeting. They carried signs that read “One Hill,” and chanted “One Hill, One Voice.”

“We want to ensure that the community surrounding this development will see tangible benefits,” he said.

People who did not attend the kick-off meeting can sign up for the focus groups by contacting the Department of City Planning, the Hill District Consensus Group or the Hill Community Development Corp.

The six focus groups are: residents; churches and social organizations; community organizations; city and public agencies; business and land owners and developers; and historic preservation groups.

-

Ohio developer builds on Pittsburgh success

By Ron DaParma

By Ron DaParma

TRIBUNE-REVIEW

Saturday, June 2, 2007Buoyed by success developing historic properties in Pittsburgh and other cities, developer John Ferchill is taking on what he terms his biggest challenge yet — a $180 million building revitalization project in Detroit.

Ferchill is deeply involved in an effort to turn the abandoned 33-story Book-Cadillac hotel in the “Motor City” into a luxury hotel and condominium project. He hopes to use some lessons learned here to aid in that effort, he said in an interview Friday.

“Pittsburgh has been just terrific for us,” said Ferchill, whose Cleveland-based company, the Ferchill Group, found success here in 2002 when he built Bridgeside Point, a five-story, 153,000-square-foot office building at the Pittsburgh Technology Center industrial park in South Oakland. In 2005, he added to his local resume with historic conversion of former H.J. Heinz Co. buildings on the North Shore into the Heinz Lofts, a 267-unit luxury apartment complex that is 95 percent leased.

And by the end of June, a development team that includes Ferchill will be reopening the Bedford Springs Resort, in Bedford County, a historic restoration project in the range of $100 million.

“We are going to use some things we learned in Pittsburgh and apply them in Detroit,” he said. “We used a couple of things with historic development that we had never used before that brought significant money for our projects.”

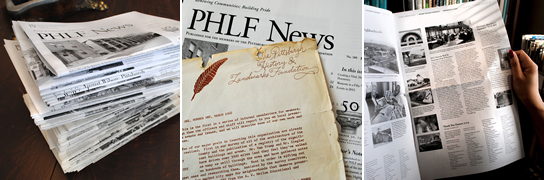

Tools used in Pittsburgh include historic tax credits and easements, said Arthur P. Ziegler Jr., president of the Pittsburgh History & Landmarks Foundation. The South Side foundation worked with Ferchill to secure the historic financing help he needed for the Heinz Lofts and Bedford Springs projects.

“John is one of the most experienced and focused developers, whether it involves new construction or restoration,” Ziegler said. “He knows how to harness together a wide variety of funding sources that make projects that seem to be impossible, possible.”

That includes the Detroit project, according to Ziegler, who became familiar with the Book-Cadillac building about a year ago while conducting a study of the site on the city’s West Side.

“It is a wonderful, historic building that will be very difficult financially to restore to make usable again,” Ziegler said. Nonetheless, he expressed confidence that Ferchill is the man to take on such a task.

“I think he can operate it very well,” Ziegler said.

“I’ve got a lot on the line here,” said Ferchill in an interview with the Wall Street Journal. His company has assumed more than $80 million in loans and other debt associated with the project, he said.

Plans are to open the building in the fall of 2008 as a 455-room Westin hotel. The top eight floors will house 67 upscale condo units, most of which already have been sold. Penthouses commanded as much as $1 million.

“I’m counting on the city of Detroit reviving itself in a manner that nobody expected to happen,” he said. Ferchill said he thinks the start of a turnaround is under way, as the city’s new ballparks, casinos and housing developments are luring more tourists and investors.

Despite his involvement in the Detroit project, Ferchill’s plans for Pittsburgh projects won’t be affected, he said.

“We have completely different teams of people working in Detroit and in Pittsburgh,” he said.

In late 2005, Ferchill sold the Bridgeside Point building at the Pittsburgh Technology Center for $31.5 million, with plans to use some of the proceeds to build a second building at the industrial park.

Plans are to break ground for that $30 million, 150,000-square-foot project within the next 30 days.

“We’re targeting technology companies, some that will have laboratory space,” he said.

Recently, local economic development officials have expressed the need for such facilities for fledgling technology firms in the region.

Ron DaParma can be reached at rdaparma@tribweb.com or 412-320-7907.